Boston Pizza Opened 10 New Restaurants in Canada in 2018

Boston Pizza International Adds 10 New Restaurants Opened in 2018 to the Royalty Pool of Boston Pizza Royalties Income Fund

VANCOUVER, Jan. 2, 2019 /CNW/ - Boston Pizza Royalties Income Fund (the "Fund") (TSX: BPF.UN) and Boston Pizza International Inc. ("BPI") announced today that effective January 1, 2019, the Fund's royalty pool (the "Royalty Pool") has been adjusted to include the 10 new full service restaurants opened across Canada between January 1, 2018 and December 31, 2018 (the "Period"), and to remove the five full service restaurants that were permanently closed during the Period. With the adjustment for these openings and closures during 2018, the Royalty Pool now includes 396 Boston Pizza restaurants. This is the 17th consecutive year of adding new Boston Pizza restaurants into the Royalty Pool.

"We are very pleased with the 10 new Boston Pizza restaurants opened in 2018, including five in Western Canada, three in Eastern Canada, and two in Québec. These new locations further strengthen our position as Canada's number one casual dining brand," said Jordan Holm, President of BPI. "Since the inception of the Fund, 242 net new Boston Pizza restaurants have been added to the Royalty Pool, growing from 154 in 2002 to 396 locations across the country today."

The Fund effectively receives 5.5% of franchise revenues of Boston Pizza restaurants in the Royalty Pool less the pro rata portion payable to BPI in respect of its retained interest in the Fund.1 Annually, the Royalty Pool of Boston Pizza restaurants is adjusted to include the new Boston Pizza restaurants that opened, and to remove Boston Pizza restaurants that permanently closed, in the prior year.

On January 1 of each year (the "Adjustment Date"), an adjustment is made to add to the Royalty Pool new Boston Pizza restaurants that opened and to remove any Boston Pizza restaurants that permanently closed since the last Adjustment Date (the "Net New Restaurants"). In return for adding net additional Royalty and Distribution Income from Net New Restaurants, BPI receives the right to indirectly acquire additional units of the Fund (in respect of additional Royalty, the "Class B Additional Entitlements" and in respect of additional Distribution Income, the "Class 2 Additional Entitlements", and collectively, "Additional Entitlements"). The calculation of Additional Entitlements is designed to be accretive to unitholders of the Fund as the expected increase in net franchise revenues from the Net New Restaurants added to the Royalty Pool is valued at a 7.5% discount. The Additional Entitlements are calculated at 92.5% of the estimated Royalty and Distribution Income expected to be generated by the Net New Restaurants, multiplied by one minus the effective tax rate estimated to be paid by the Fund during that year, divided by the yield of the Fund, divided by the weighted average unit price over a specified period. BPI indirectly receives 80% of the Additional Entitlements initially, with the balance received when the actual full year performance of the Net New Restaurants and the actual effective tax rate paid by the Fund are known with certainty (such balance of units in respect of the additional Royalty, the "Class B Holdback", and in respect of the additional Distribution Income, the "Class 2 Holdback", and collectively, the "Holdback"). BPI indirectly receives 100% of distributions from the Additional Entitlements (including the Holdback) throughout the year. Once the Net New Restaurants have been part of the Royalty Pool for a full year, an audit of the franchise revenues of these restaurants is performed, and the actual effective tax rate paid by the Fund is determined. At such time, an adjustment is made to reconcile distributions indirectly paid to BPI and the Additional Entitlements indirectly received by BPI.

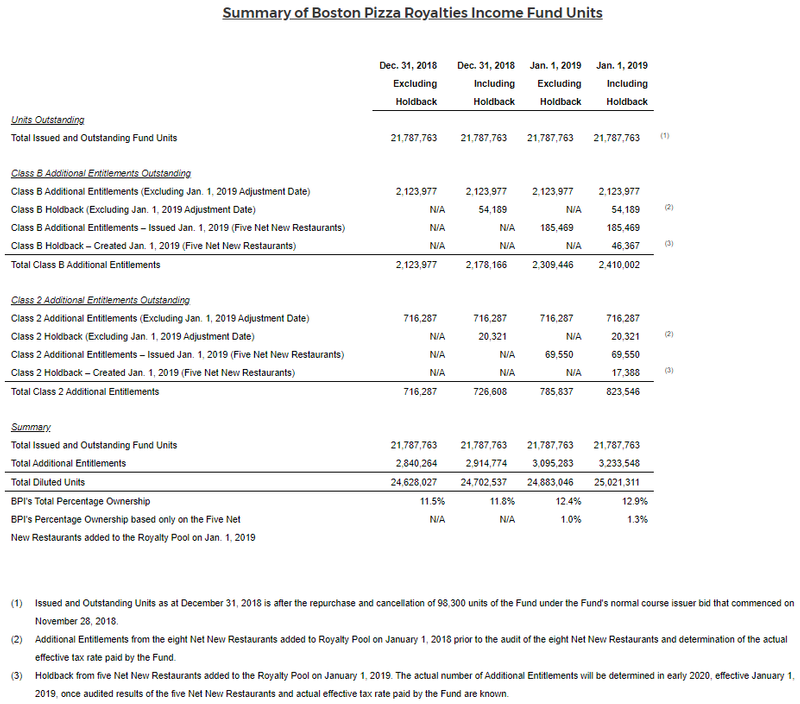

In return for adding net additional Royalty and Distribution Income from the five Net New Restaurants added to the Royalty Pool, BPI indirectly received 255,019 Additional Entitlements (representing 80% of the total Additional Entitlements), comprised of 185,469 Class B Additional Entitlements and 69,550 Class 2 Additional Entitlements, and the Holdback is 63,755 Additional Entitlements (representing 20% of the total Additional Entitlements), comprised of 46,367 Class B Holdback and 17,388 Class 2 Holdback. The Holdback (as adjusted) will be indirectly received by BPI when both the actual full year performance of the Net New Restaurants and the effective tax rate paid by the Fund are known with certainty. Including the 255,019 Additional Entitlements, BPI indirectly holds Class B general partner units of Boston Pizza Royalties Limited Partnership that are exchangeable for 2,309,446 Fund units, and Class 2 general partner units of Boston Pizza Canada Limited Partnership that are exchangeable for 785,837 Fund units. Together, the Class B general partner units of Boston Pizza Royalties Limited Partnership and Class 2 general partner units of Boston Pizza Canada Limited Partnership indirectly held by BPI are currently exchangeable for 3,095,283 Fund units, representing the equivalent of a 12.4% interest in the Fund on a fully-diluted basis. The 318,774 Additional Entitlements (being the 255,019 Additional Entitlements indirectly received by BPI plus the 63,755 Holdback) represent 1.3% of Fund units on a fully diluted basis. Including the 318,774 Additional Entitlements described above, BPI indirectly has the right to acquire 3,233,548 Fund units, representing a 12.9% interest in the Fund on a fully diluted basis. The issuance of the Additional Entitlements indirectly to BPI has been conditionally approved by the Toronto Stock Exchange and remains subject to its final approval.

The estimated annual franchise revenues in 2019 for the 10 new Boston Pizza restaurants that opened in 2018 is $18.7 million. BPI is required to deduct from this amount the actual franchise revenues received from the five Boston Pizza restaurants that permanently closed in 2018 during the first 12 month period immediately following their addition to the Royalty Pool, which is $6.9 million. Consequently, the estimated annual net franchise revenues in 2019 for the five Net New Restaurants added to the Royalty Pool on January 1, 2019 is $11.8 million. The estimated Royalty and Distribution Income expected to be generated by these five Net New Restaurants is 5.5% of this amount, or $0.7 million. The pre-tax amount for the purposes of calculating the Additional Entitlements, therefore, is approximately $0.6 million or 92.5% of $0.7 million. The estimated effective tax rate that the Fund will pay in the calendar year 2019 is 27.0%. Accordingly, the after-tax additional Royalty and Distribution Income for the purposes of calculating the Additional Entitlements is approximately $0.4 million ($0.6 million x (1 – 0.27)). Once the actual performance of the 10 new Boston Pizza restaurants added to the Royalty Pool on January 1, 2019 for 2019 and the actual effective tax rate paid by the Fund for 2019 are known, the number of Additional Entitlements will be adjusted in 2020 to reflect the actual franchise revenues generated by these Boston Pizza restaurants in 2019 and the actual effective tax rate paid by the Fund in 2019.

See the Fund's annual information form dated February 7, 2018 for a detailed description of the annual adjustment that is made to the Royalty Pool. Depending on market conditions and internal considerations, BPI may acquire or dispose of additional securities of the Fund in the future.

The following table sets forth a summary of the issued and outstanding units of the Fund, together with Additional Entitlements, as at both December 31, 2018 and January 1, 2019.

ABOUT US

The Fund is a limited purpose open ended trust with an excellent track record for investors since its IPO in 2002. Including the December 2018 distribution which will be payable on January 31, 2019, the Fund will have delivered 18 distribution increases and 198 consecutive monthly distributions to unitholders totalling $306.8 million or $20.64 per unit since 2002. The Fund earns revenue based on the franchise system sales of the 396 Boston Pizza restaurants included in the Fund's royalty pool.

Boston Pizza is Canada's number one casual dining brand with annual gross sales in excess of $1.1 billion serving more than 50 million guests through over 395 mainly franchisee operated restaurants. The Boston Pizza brand has successfully existed for over 50 years since opening its first restaurant in Edmonton, Alberta in 1964. BPI has been recognized as a Platinum Member of Canada's 50 Best Managed Companies and has been a Franchisees' Choice Designation winner for six consecutive years.

Certain information in this press release constitutes "forward-looking information" that involves known and unknown risks, uncertainties, future expectations and other factors which may cause the actual results, performance or achievements of the Fund, Boston Pizza Holdings Trust, Boston Pizza Royalties Limited Partnership, Boston Pizza Holdings Limited Partnership, Boston Pizza Holdings GP Inc., Boston Pizza GP Inc., BPI, Boston Pizza Canada Limited Partnership, Boston Pizza Canada Holdings Inc., Boston Pizza Canada Holdings Partnership, Boston Pizza restaurants, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the Fund or management of BPI expects or anticipates will or may occur in the future, including adjustments to the Royalty Pool on the Adjustment Date, calculation and timing of payment of Additional Entitlements and Holdback, an audit of franchise revenues being performed and an adjustment to reconcile distributions indirectly paid to BPI and the Additional Entitlements indirectly received by BPI being made, the estimated annual gross franchise revenue received from the 10 new Boston Pizza restaurants that opened in 2018, the estimated effective tax rate that will be paid by the Fund for 2019 and other such matters are forward-looking information. When used in this press release, forward-looking information may include words such as "estimate", "will", "expect" and other similar terminology. The material factors and assumptions used to develop the forward-looking information contained in this press release include the following: future results being similar to historical results, expectations related to future general economic conditions, business plans, receipt of franchise fees and other amounts, franchisees access to financing, pace of commercial real estate development, protection of intellectual property rights of Boston Pizza Royalties Limited Partnership, absence of changes of laws, absence of amendments to contracts and the Toronto Stock Exchange granting final approval for the issuance of the Additional Entitlements. Risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievement expressed or implied by the forward-looking information contained herein, relate to (among others) competition, demographic trends, consumer preferences and discretionary spending patterns, business and economic conditions, legislation and regulation, distributable cash and reliance on operating revenues, accounting policies and practices, the results of operations and financial condition of BPI and the Fund, as well as those factors discussed under the heading "Risks and Uncertainties" in the Fund's Management Discussions and Analysis for the third quarter of 2018. This information reflects current expectations regarding future events and operating performance and speaks only as of the date of this press release. Except as required by law, the Fund and BPI assume no obligation to update previously disclosed forward-looking information. For a complete list of the risks associated with forward-looking information and our business, please refer to the "Risks and Uncertainties" and "Note Regarding Forward-Looking Information" sections included in the Fund's Management's Discussion and Analysis for the third quarter of 2018 available at www.sedar.com and www.bpincomefund.com.

The Trustees of the Fund have approved the contents of this news release. To obtain a copy of the early warning report filed in respect of the Additional Entitlements, and for further information, please contact:

Jordan Holm

President

Boston Pizza Royalties Income Fund / Boston Pizza International Inc.

100 – 10760 Shellbridge Way, Richmond, B.C., V6X 3H1

Tel: 604-270-1108

E-mail: investorrelations@bostonpizza.com

www.bpincomefund.com

® Boston Pizza Royalties Limited Partnership. All Boston Pizza registered Canadian trade-marks and unregistered Canadian trade-marks containing the words "Boston", "BP", and/or "Pizza" are trademarks owned by Boston Pizza Royalties Limited Partnership and licensed by Boston Pizza Royalties Limited Partnership to Boston Pizza International Inc.

_______________________________

1 The Fund indirectly owns the Boston Pizza trademarks and trade names used by Boston Pizza restaurants in Canada. In 2002, the Fund licensed these trademarks to BPI for 99 years and in return BPI pays the Fund a top line royalty of 4% of franchise revenues of Boston Pizza restaurants in the Royalty Pool ("Royalty"). On May 6, 2015, the Fund completed an indirect investment in Boston Pizza Canada Limited Partnership (a limited partnership controlled and operated by BPI) that entitles the Fund to receive distribution income from Boston Pizza Canada Limited Partnership ("Distribution Income") equal to 1.5% of franchise revenues of Boston Pizza restaurants in the Royalty Pool less the pro rata portion payable to BPI in respect of its retained interest in the Fund.

SOURCE Boston Pizza Royalties Income Fund

For further information: Jordan Holm, President, Boston Pizza Royalties Income Fund / Boston Pizza International Inc., 100 - 10760 Shellbridge Way, Richmond, B.C., V6X 3H1, Tel: 604-270-1108, E-mail: investorrelations@bostonpizza.com, www.bpincomefund.com